A Commercial Invoice is an important document that is used in international trade and shipping. When products are shipped Internationally the shipper must provide the Consignee (importer) with a detailed Commercial Invoice template and other shipping documentation.

The template for a Commercial Invoice will contain all important information and instructions for importers, freight forwarders, customs, agents and banks (if required) to use during the import export process. The Commercial Invoice will contain product and transactional information, HS codes, Incoterm®, details of the exporter & consignee and shipping details such as type of shipment, port of loading and port of discharge.

When products are shipped internationally, the exporter, acting as the seller, creates a Commercial Invoice template and other shipping documentation to share with the importer, effectively transferring the details of the sale from the seller to the buyer.

As a key customs document, the Commercial Invoice template, along with packing lists and other common export documents, is used by the importer to facilitate the clearance of products through customs in the country of import. This comprehensive documentation aids customs authorities in accurately assessing customs duties, ensuring that all applicable tariffs and taxes are correctly applied to the imported goods.

A Commercial Invoice must be provided for all seafreight and airfreight shipments. For example, if you are sending airfreight shipments with FedEx or DHL you will have to provide to FedEx a Commercial Invoice, or provide to DHL a Commercial Invoice.

Note that a Commercial Invoice is issued after the goods have been delivered or shipped (post-shipment). In some cases, exporters will provide a Proforma Invoice before the goods have been shipped (pre-shipment), then provide a Commercial Invoice post shipment.

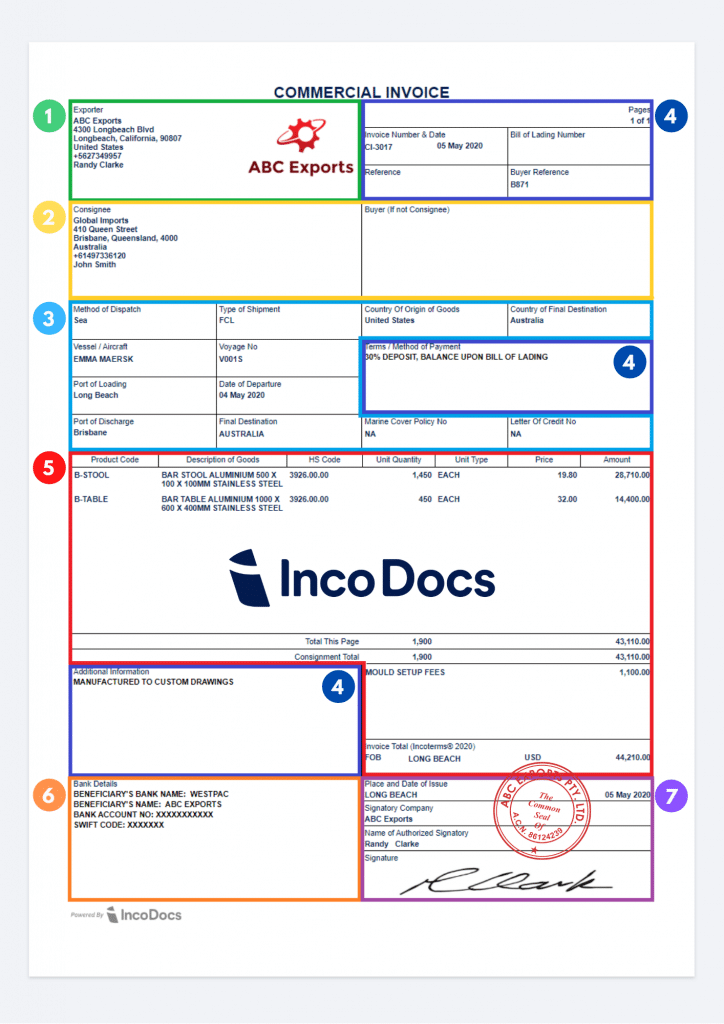

As mentioned above, it’s important that exporters include all information on the Commercial Invoice template to avoid having issues or delays when transporting the goods and when clearing through customs in the country of import. We’ve split the Commercial Invoice into sections to make it easy to understand where relevant information is required. Starting at the top left is the details of the Exporter of the goods:

This includes basic company contact information including company name, logo, address, phone numbers and personal contact details.

This includes basic company contact information including company name, address, phone numbers and personal contact details.

Important shipping and logistics details are included to help the consignee, logistics companies and customs brokers to correctly arrange the transportation, customs clearance and final delivery of goods. Shipping details include:

These sections includes reference numbers, dates and additional information:

The exporter will add a detailed list of the products that have been sold. This includes important information such as:

The seller’s detailed bank information. This usually includes:

To finalize the document, the seller can add their signatory details:

In summary, the Commercial Invoice serves not only as a record of the sale from the seller to the buyer but also as a critical customs document that ensures the smooth processing of goods through international customs, facilitating global trade efficiently and effectively

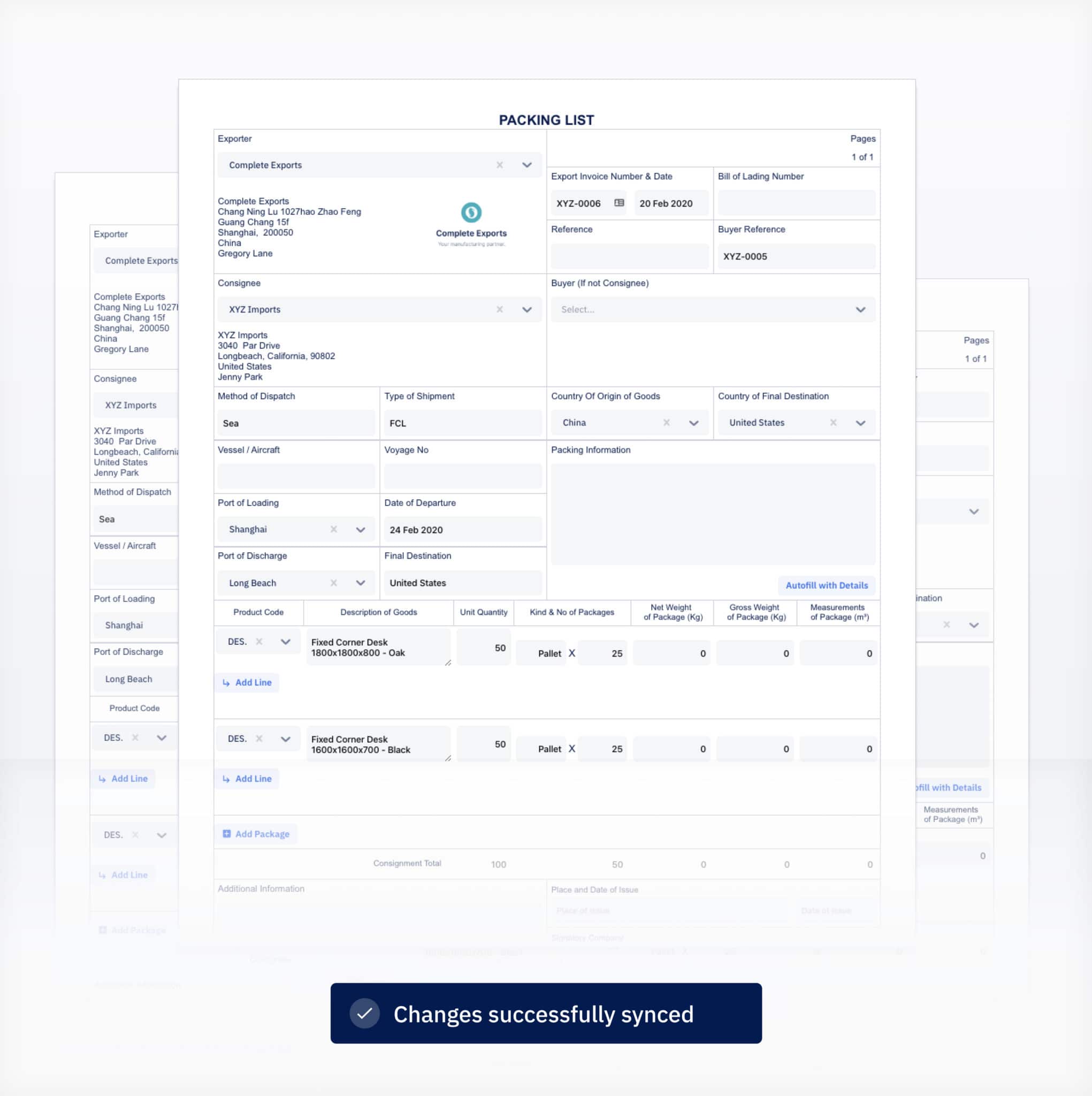

Exporters use IncoDocs to connect teams to create and manage shipping documents in 1 place and eliminate manual data re-entry. Once goods have been shipped, exporters can create and manage their full set of shipping documents in a shared team workspace. Users eliminate data re-entry by entering data into 1 master screen then have everything instantly sync to all shipping documents required.

Shipping documents include Commercial Invoices, Packing Lists (for FCL, LCL Air or Consolidated shipments), Verified Gross Mass Declarations (VGM), Shipper’s Letter of Instruction (SLI), Forwarding Instructions (FI), Manufacturer’s Declarations and other shipping documentation.

A full set of shipping documents can be duplicated at the click of a button to save even more time and require only minimal data entry for new shipments.

Read more about how exporters use IncoDocs to connect their team to create compliant Commercial Invoices and shipping documentation.

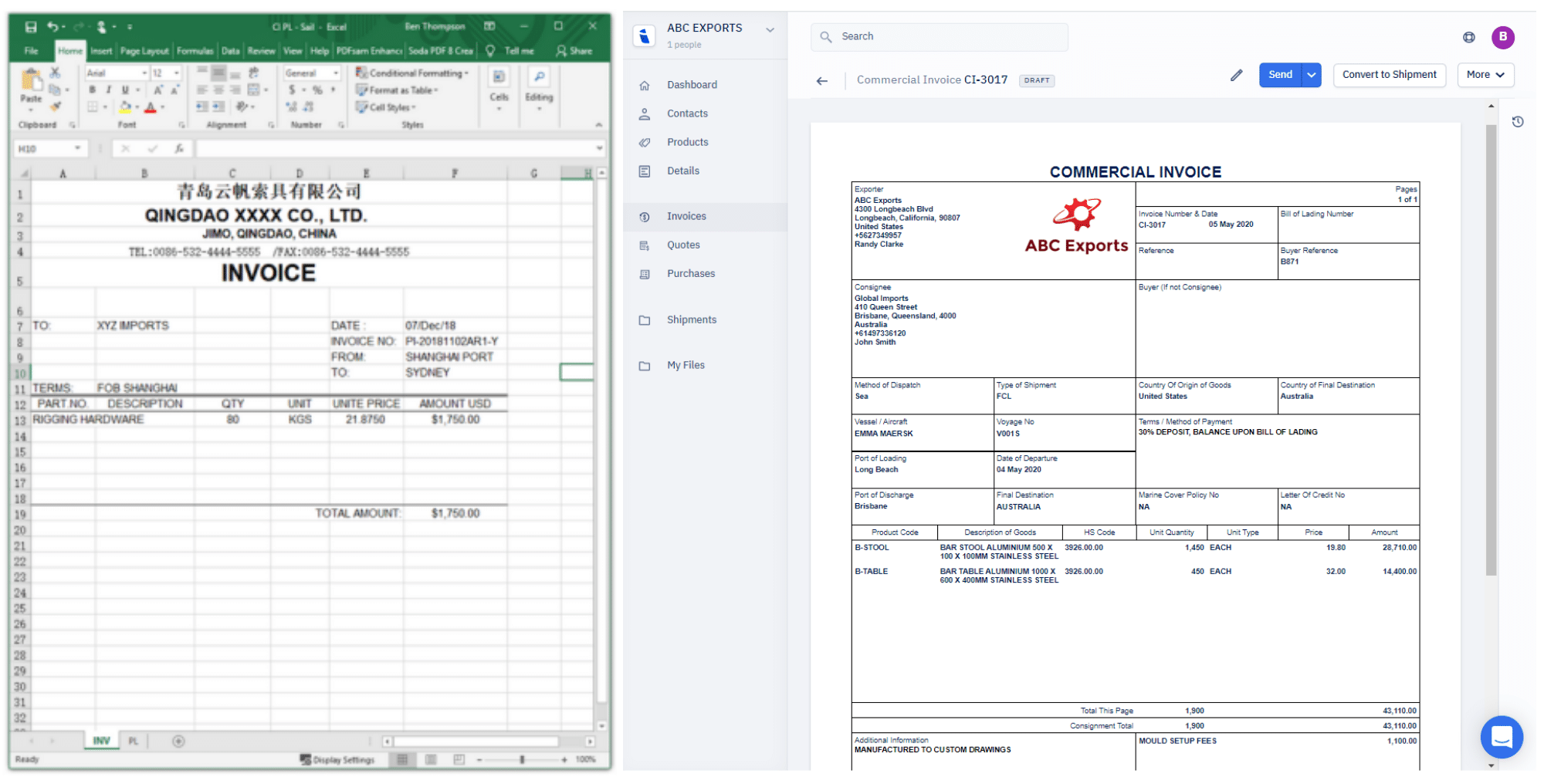

Some export companies have created templates for Commercial Invoices and other shipping documents using Word or Excel templates. Usually someone in the company set up a process that requires employees retyping data or copying and pasting between document templates.

Because of this, it creates an unreliable process that is prone to human error. Every time that data is re-entered there is a real risk to your business. When updates are made to regulations and documentation requirements, team members still create out-dated templates. One simple error on a Commercial Invoice or shipping document can cause problems such as delays, fines and missed shipments.

While a proforma invoice is a preliminary document sent to the buyer before the completion of the sale, a commercial invoice is used after the sale is made. The Commercial Invoice is used by the importer to facilitate the clearance of products through customs in the country of import. Local customs will use the Commercial Invoice document to accurately assess customs duties, ensuring that all applicable tariffs and taxes are correctly applied to the imported goods.

Commercial invoices are important documents in international trade as they are used by customs officials to classify the products, verify the value and origin of the goods. They play a crucial role in the assessment of duties and taxes in the customs clearance process.

The Automated Export System (AES) is a system used by the U.S. government to collect electronic export information from shipping documentation. The commercial invoice is an important component of the AES, providing crucial data about the exported goods that is required by the system for export control purposes. The exporter or the authorized agent will transmit the commodity information using the AES system.

Accuracy in the commercial invoice is crucial in foreign trade as it impacts the assessment of customs duties and taxes. Any discrepancies or inaccuracies in the commercial invoice can lead to delays in customs clearance and may result in additional costs or penalties. The products included on the commercial invoice must be correctly classified using HS or HTS codes. Its best to get professional advice from your freight forwarder or customs clearance agent with help in correctly classifying the products to be imported.

Ben is passionate about International Trade, Import/Export, International Shipping and connecting world markets. For the last 14 years Ben has specialized in importing and exporting goods around the world, and creating software solutions to streamline the import/export process.