The Employee Retention Tax Credit (ERTC) is on many companies’ minds. Here, we’ve answered some frequently asked questions—from what it is and how it’s calculated to how guidance from the IRS may impact organizations.

The Employee Retention Tax Credit is an incentive originally created within the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) intended to encourage employers to keep employees on the payroll as they navigate the unprecedented effects of COVID-19. Eligible employers can get a refundable payroll tax credit equal to a percentage of eligible wages. Originally, employers were not allowed to obtain a PPP loan and claim the ERTC. The Consolidated Appropriations Act provided a much-welcomed modification to the CARES Act by allowing all eligible employers to claim the ERTC, even if they have received a PPP loan. The Act also extended the ERTC to early 2021. The American Rescue Plan (ARP) further extended the ERTC to the end of 2021 (now ending September 30, 2021 with the passing of the Infrastructure Investment and Jobs Act). For 2021, eligible employers can get a credit equal to 70 percent of qualifying wages per quarter. The maximum credit per quarter is $7,000 per employee. The Infrastructure and Investment Jobs Act made an additional change to the ERTC program. Wages paid after September 30, 2021 are no longer considered eligible wages for ERTC purposes. You may be asking yourself, what if I already filed Form 7200 for an advance refund or withheld tax deposits in anticipation of claiming the ERTC for the fourth quarter of 2021? The IRS issued additional guidance this week clarifying the process. If an advance was received for Q4 2021, it will have to be repaid by the due date of Form 941 for the fourth quarter. Failure to repay these funds by that due date will result in the imposition of failure to pay penalties. For taxpayers who instead reduced their required deposits, the IRS will no longer waive failure to deposit penalties for employers that reduce deposits after December 20, 2021. The amounts withheld from the required tax deposits earlier in the quarter will need to be deposited on or before the due date for Form 941 for wages paid on December 31, 2021. The notice also suggests taxpayers can appeal to the IRS under “reasonable cause” relief if they don’t qualify under this notice for relief of these penalties.

Gross receipts include all receipts received, regardless of whether the amounts are derived in the ordinary course of the taxpayer’s trade or business.

It’s also important to note that there are affiliation rules that apply to commonly owned businesses which could impact eligibility for the credit.

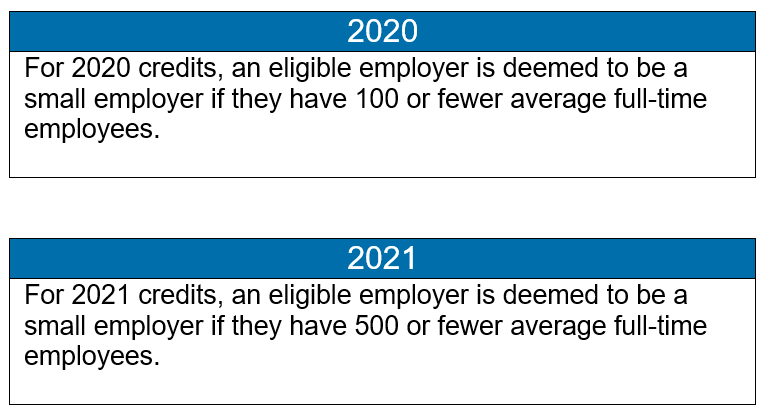

The number of average full-time employees is important because this calculation determines which wages would be available for the credit.

There are different definitions for eligible wages based on whether the employer is a small or large employer. In order to determine the employer status for the ERTC, the average number of full-time employees employed during 2019 must be determined.

The 2019 reference period for the full-time employees calculation is to be used for both the 2020 and 2021 eligibility period.

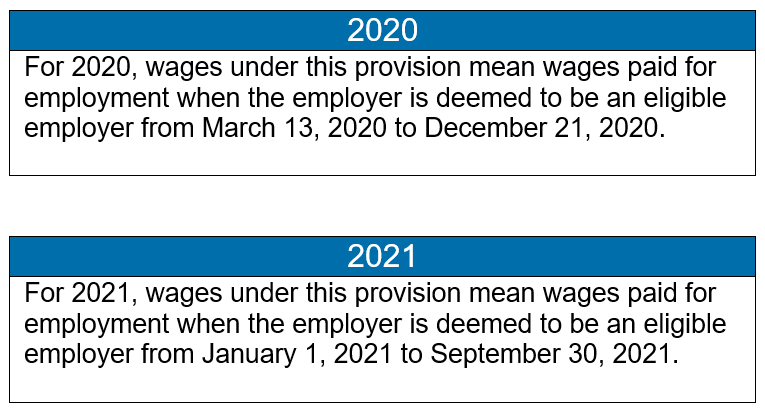

Eligible wages under the ERTC for a small employer are all wages and health insurance benefits paid to an employee during the time period in which the employer is considered an eligible employer.

Eligible wages under the ERTC for an eligible employer that is not considered to be a small employer are wages and health insurance benefits paid to an employee who is not providing services due to the effects of the pandemic.

In addition, eligible wages paid to an employee in this category cannot be in excess of the amount such an employee would have been paid 30 days immediately preceding the pandemic.

Eligible wages can only be incurred when the employer is considered an eligible employer. Therefore, if the employer no longer meets the criteria for eligibility, generally they no longer have eligible wages for the credit.

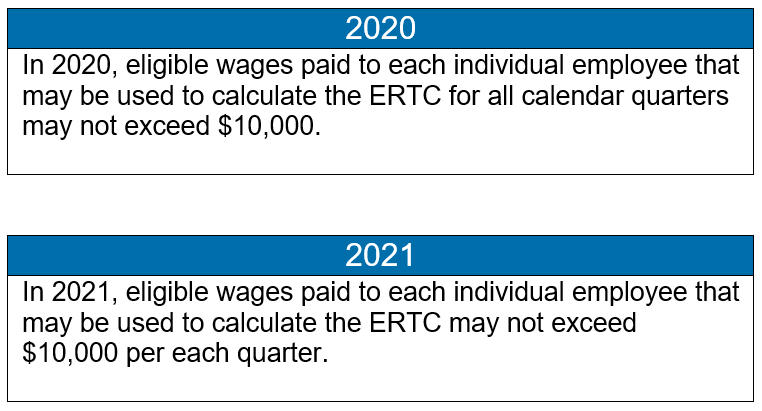

In 2020, eligible wages paid to each individual employee that may be used to calculate the ERTC for all calendar quarters may not exceed $10,000. In other words, the employer is allowed a maximum $5,000 ($10,000 x 50 percent) credit per employee for all calendar quarters in which eligible wages are paid.

In 2021, eligible wages paid to each individual employee that may be used to calculate the ERTC may not exceed $10,000 per each quarter. In other words, the employer is allowed a maximum $7,000 ($10,000 x 70 percent) credit per employee for each calendar quarter in which eligible wages are paid. Any eligible wages taken into account in determining the ERTC allowed shall not be taken into account as wages for purposes of various other tax credits and PPP loan forgiveness.

It’s important to note that the ERTC is subject to income tax due to the fact that the employer’s aggregate salary deductions are reduced by the amount of the credit.

The ERTC is a payroll tax credit (not an income tax credit) and is ultimately to be reported on Form 941. Eligible employers can claim the ERTC by computing the ERTC amount for a pay period and decreasing the required payroll deposit by that amount.

In anticipation of receiving the ERTC, employers can reduce employment tax deposits with the IRS or request an advance of the ERTC from the IRS on Form 7200 Advance Payment of Employer Credits Due to COVID-19.

Advance payments are available to small employers (less than 500 full-time employees) due to some limitations, including:

In any calendar quarter in which the amount of the ERTC is in excess of the OASDI taxes imposed on the employer, the excess is treated as a refundable overpayment.

On March 1, 2021 and April 2, 2021, the IRS issued the much-awaited guidance (IRS Notice 2021-20 and 2021-23) regarding the ERTC.

Notice 2021-20 brought clarity regarding how the PPP and ERTC will work together. A Q&A format is used to explain how an election is made and how excess wages used on a loan application are to be handled. Question 49 of the notice specifically speaks to the interaction and gives seven detailed examples of various scenarios. In a nutshell:

The new guidance explains that the election is made by simply not claiming the ERTC for those specific wages on the applicable 941 return.

Notice 2021-23 contains ERTC guidance for the first and second quarters of 2021, including more details on definition changes and other modifications to the ERTC for 2021.

The notices also included a few additional clarifications, including how to claim the 2020 and 2021 credits, details on the interaction with other deferrals, clarification on the definition of wages and documentation requirements needed.

The ARP extended the ERTC through the end of 2021, and it also expanded the program in many ways, including creating additional categories for recovery startup businesses and severely distressed employers.

The IRS has been busy in August 2021 providing new guidance. First, IRS issued Notice 2021-49 that provides guidance for third and fourth quarters of 2021, addresses the new programs and also amplifies previously issued notices 2021-20 and 2021-23 clarifying many of our unanswered questions.

A few of the significant questions addressed are noted below:

The IRS also has issued Revenue Procedure 2021-33 which provides a safe harbor for calculating gross receipts. Per the Revenue Procedure, gross receipts does not include PPP loan forgiveness, Shuttered Venue Operator Grants and Restaurant Revitalization Grants. This is welcome guidance for those that received other COVID-19 assistance.

This article was originally published on May 5, 2020 and was most recently updated on December 20, 2021.

Our clients are seeing advertisements, receiving emails and even calls on a regular basis by companies wanting to perform ERTC calculations for them. They are utilizing very aggressive marketing tactics to sell this service to taxpayers that may or may not qualify for the credit. Many are claiming that the qualifications have recently changed. However, the guidance for ERTC qualification has not changed. The ERTC is a legal tax filing that the taxpayer (the organization receiving the credit—not the company doing the filing) attests is accurate in every way, including qualification. See the IRS’s official warning regarding ERTC scams and warning signs.

This article reflects our views at the time this article was written and should be used as reference only. We recommend that you talk to your Warren Averett advisor, or another business advisor, for the most current information or for guidance specific to your organization.